Best CA firm for GST Return filing in Jaipur

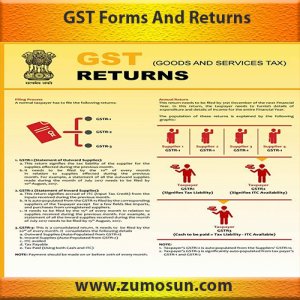

Every person registered under the GST Act has to periodically furnish the details of sales and purchases along with tax collected and paid thereon, respectively, by filing online returns. Before filing the return, payment of tax due is compulsory otherwise such return will be invalid.

Type of GST Return:

GSTR 1

GSTR 1 is a monthly return of outward supplies. Essentially it is a return showing all the sales transaction of a business.

GSTR 2

Every registered taxable person is required to give details of inward supply i.e. purchases for a tax period in GSTR2.

GSTR 3

GSTR3 is a monthly GST return. It contained two parts i.e. Part A, Part B. Part A of the return shall be electronically generated on the basis of information furnished through return in form GSTR1, form GSTR2 and based on other liabilities of preceding tax periods. Part B contained the tax liability, interest and penalty paid and refund claimed from cash ledger, if any. Part B is also auto populated, the system will compute the tax liability on the basis of GSTR1 (OUTPUT TAX) and after adjustment of input tax credit as claimed in GSTR-2.

GSTR 4

GSTR4 is a GST return that has to be filled by a composition dealer. Unlike a normal taxpayer who needs to furnish three monthly returns, a dealer opting for the composition scheme is required to furnish only one return which is GSTR4.

GSTR 5

GSTR5 is return form that has to be filed by a non-resident foreign taxpayer who is registered under GST for the period during which they carry out business transactions in India. This can either be done online or from a tax facilitation centre. GSTR5 has to be filled and the tax (including penalty, fees, interest etc.) is to be paid every month (for the registration period) by 20th of the next month for a particular tax period or within seven day after the end of the validity period of registration.

GSTR 6

GSTR6 is a monthly return that has to be filed by an input services distributor. It contains details of ITC received by an input services distributor and distribution of ITC. There are a total 11 sections in this return.

GSTR 7

GSTR7 is a return to be filed by the persons who is required to deduct TDS under GST, GSTR7 contains the details of TDS deducted, TDS liability payable and paid, TDS refund claimed if any etc.

GSTR 8

GSTR-8 is a return to be filed by the e-commerce operators who are required to deduct TCS (Tax collected at source) under GST. GSTR-8 contains the details of supplies effected through e-commerce platform and amount of TCS collected on such supplies.

GSTR 9

GSTR 9 form is an annual return to be filed once in a year by the registered taxpayers under GST. It consists of details regarding the supplies made and received during the year under different tax heads i.e. CGST, SGST and IGST. It consolidates the information furnished in the monthly or quarterly returns during the year.

GSTR 10

A taxable person whose GST registration is cancelled or surrendered has to file a return in the form of GSTR-10. This return is called as final return.

GSTR 11-GSTR-11 is the return to be filed by the persons who has been issued a Unique Identity Number (UIN) in order to get refund under GST for the goods and services purchased by them in India.

Due Date

GSTR 1

The GSTR1 form is a return form for the regular taxpayers who have to file details of outward supplies on every 10th if next month for those who cross the turnover more than 1.5 crore annually.

GSTR 2

GSTR2 due date for filling GSTR2 is 15th of the next month. There is 5-day gap between GSTR1 and GSTR2 filling to correct any errors and discrepancies.

GSTR 3

GSTR3 has to file on or before 20th of the following month.

GSTR 4

GSTR4 has to be filled on a quarterly basis. The due date for filling GSTR4 is 18th of the month after the end of quarter.

GSTR 5

GSTR5 has to be filled and the tax (including penalty, fees, interest etc.) is to be paid every month (for the registration period) by 20th of the next month for a particular tax period or within seven day after the end of the validity period of registration.

GSTR 6

The due date for filling of GSTR6 as per GST act is 13th of next month.

GSTR 7

Filling of GSTR7 for a month is due on the 10th of following month. For instance, due date of filling GSTR7 for October is 10th November.

GSTR 8

GSTR-8 filing for a month is due on 10th of the following month. For instance, the due date for GSTR-8 for October is on the 10th of November.

GSTR 9

GSTR-9 due date is on or before 31st December of the subsequent financial year.

GSTR 10

GSTR 10 must be filed within three months from the date of cancellation or date of cancellation order whichever is later. For instance, if the date of cancellation is 1st September, 2018, then the GSTR 10 must be filed by 30th November, 2018.

GSTR 11

GSTR 11 must be filed by the 28th of the month following the month in which inward supply is received by the UIN holders.

Process

-

Registration

Make sure that you are registered under GST and have the 15-digit GST identification number with you based on your state code and PAN. In case you do not have this number, first register online to get it. -

Login,Search

Next,visit the GST portal

Click on the 'Service' Button.

Click on 'Return dashboard' and then, from the drop-down menu,fill in financial year and return filing period. now select the return you want to file and click on 'Prepare online' -

Details

Enter all the required values including the amount and late fee, if applicable.Once you have filled in all the details, click on ‘Save’ and you will see a success message displayed on your screen.

-

Submit

Now click on ‘Submit’ at the bottom of the page to file the return.Once the status of your return changes to ‘Submitted’, scroll down and click on the ‘Payment of tax’ tile. Then, click on ‘Check balance’ to view cash and credit balance, so that you know these details before paying tax for respective minor heads. Next, to clear your liabilities, you need to mention the amount of credit you want to use from the credit already available. Then click on ‘Offset liability’ to make the payment. When a confirmation is displayed, click on ‘OK’.

-

Attach DSC

Lastly, check the box against the declaration and select an authorised signatory from the drop-down list. Now click on ‘File form with DSC’ or ‘File form with EVC’ and then click on ‘Proceed’. Make the payment in the next step for your respective GST form.

Benefits of GST Return

- Removing cascading tax effect

- Entities engaginHigher threshold for registration

- Composition scheme for small businesses

- Simpler online procedure under GST.

- Lesser number of compliances

- Regulating the unorganized sector

- Defined treatment of E-Commerce

- Increased efficiency of logistics.

No reviews found.

No comments found for this product. Be the first to comment!